May 2024

New Point of Sale Devices Available on our FINIX_V1 Processor

Pax A920 Pro

The PAX A920 Pro is an upgraded version of the A920 with a faster processor, larger HD screen, professional infrared barcode scanner, and a 5MP camera. It supports a wide range of advanced connectivity options, NFC contactless, and electronic signature capture,

Pax A800

The A800 offers high performance and the flexibility to be used as either a countertop device or mobile solution. Used as a countertop device, connected to an optional hub, the A800 allows merchants to connect to the Internet via Ethernet.

Pax MPOS

Weighing less than 3 oz, the ultra-light D135 packs high efficiency and portability to deliver a seamless payment experience for merchants of any size. You can take NFC payments, chip payments, and swiped cards.

You can connect this device to a phone or tablet via Bluetooth or with a wired USB chord.

New Tipping Configurations

You now choose how to configure tipping on in-person devices using the Finix Dashboard and via API.

We support three values for different tip percentages. We also let buyers enter in a custom tip amount.

You have the option to do fixed amounts for lower transaction amounts. This feature is helpful for coffee shops or other locations with variable low and high transaction amounts.

Finix Dashboard is now Mobile Responsive

We updated the Finix Dashboard to be mobile responsive. Merchants can use the Virtual Terminal and Payment Links easily on their phones to take a payment. You can also view our insights on the go using your phone or tablet.

Payout Links

Payout Links are one-time use links to send a payout to a recipient. You can email or text the link to your recipient. If conducting a card payout, funds are usually available in minutes.

You can use payout links to send insurance payouts, sales commissions, and more. You can customize the payout link with your brand name and logo.

Learn more about Payout Links here.

April 2024

Sub-merchant Dashboard Updates

Payment Links are now available to sub-merchants

Sub-merchants will now be able to create Payment Links and send them to their buyers. They can customize the branding for the payment link, items, expiration time, and the allowed payment methods. Read more about Payment Links here.

Virtual Terminal now available to sub-merchants

Sub-merchants can now create Sales and Authorizations on the Dashboard using the virtual terminal. They can enter card information and create a transaction on our white-labeled dashboard.

Sub-merchants now have access to our Insights data

Sub-merchants will have access to high-level business insights on the home page and more granular insights related to their payments, authorizations, and refunds on the Transactions Insights page. They can view their transaction volume, trends, and more within our white-labeled dashboards.

Updated Left Navigation Bar

We’ve updated our left nav bar to a lighter theme to better match the aesthetics of the dashboard. If you have custom branding on the dashboard, your view will be unaffected by this change.

Send Money on the Dashboard

You now have the option to send payouts to previously onboarded recipients using the dashboard. You can also add a new recipient on the dashboard and send them money once they are successfully onboarded.

Token Form Updates

We’ve updated our finix.js library to version 1.1.0. This is our javascript library for tokenizing payment instruments using our Token Forms.

Summary of our recent changes:

-

Added support for a new

defaultCountryoption to set the default country experience for your Tokenization form. -

We removed all address fields from the Bank Tokenization Form except for the

countryfield, which was not required to tokenize bank accounts. -

onUpdate function's first param

statenow returns additional metadata for select fields calledselected. Currently supported fields are:account_type,address_stateandaddress_country. -

We fixed a bug related to loading the Tokenization library when only

address_stateis hidden.

March 2024

Seamlessly add and verify merchant bank accounts with Plaid

We’ve partnered with Plaid to help you instantly add and verify merchant bank accounts during onboarding with a seamless and secure flow for your sellers, buyers, and recipients.

Embedded Verification: Plaid is now directly embedded into our no-code Onboarding Forms, giving merchants the option to link their financial accounts in seconds using their banking credentials. Finix supports Plaid bank authentication for thousands of U.S. and Canadian institutions, so you can quickly confirm account existence and ownership to sign up trusted merchants for payments.

Dashboard Enhancement: We’ve added Plaid’s authentication flow to Finix dashboards to equip your merchants with a simple way to update their bank accounts.

API Flexibility: You can leverage our partnership to integrate Plaid into your own onboarding forms or product experience using Finix’s APIs. This helps you create tailored bank account processes that meet your specific business needs.

Read our integration guide to learn more.

February 2024

Finix is now live in Canada 🇨🇦

We’re excited to announce our launch as a payment processor in Canada! Our unified platform now equips Canadian businesses with everything you need to accept payments online and in person and efficiently manage your business, including embedded tools for financial reporting, fraud prevention, compliance and more.

Our flexible technology is built to support the needs of Canadian businesses of all sizes and industries, from software platforms to digital marketplaces and many types of ecommerce and merchant businesses. If you’re a Canadian business or international business with a Canadian presence, Finix is here to help you simplify cross-border payments with a platform purpose-built for growth.

Read our announcement blog to learn more.

Automate your merchant underwriting with Finix’s new solution

Introducing Merchant Underwriting! Our new solution automates underwriting workflows to help you onboard merchants faster and more efficiently scale your business. Use our solution to underwrite merchants for payments with any processor or power merchant verification for a variety of financial use cases.

Bring your underwriting processes together in a single place:

- Easily collect onboarding information with prebuilt flows you can customize to your brand

- Automate identity verification and compliance reporting, risk scoring and underwriting decisioning

- Efficiently manage cases and manual reviews with enriched decision data, contextual insights and built-in dashboard workflows

- Get visibility and control over your underwriting operations, merchant statuses and seller compliance forms

Reduce time-to-decisions to seconds without compromising risk through streamlined underwriting orchestration.

To learn more, visit Merchant Underwriting.

Easily add and manage terminals in your dashboard

We’ve built a new Payment Devices section in your Finix dashboard that helps you add, manage, and configure your payment terminals in a single place.

Seamlessly manage your fleet across all your locations with self-service capabilities to:

- Quickly add, configure, and activate new terminals

- Manage all your terminals from a centralized view

- Customize and enable device settings

- Easily track each terminal’s real-time status, processed transactions, and idle messages

- Check connections, ping devices and deactivate terminals for quick troubleshooting

Please note, device management only applies to Finix-supported terminals.

January 2024

Send money with Finix Payouts

Introducing Finix Payouts! Send fast digital payouts from your business to a business or individual recipient’s card or bank account. With our new solution you can easily automate payout workflows via API and send money at scale.

No matter your use case, we’ve got you covered. Power near limitless payout possibilities—like disbursing funds for gig workers, insurance claims, deposit refunds, payroll and more.

Use Finix Payouts to flexibly send money on the timeline you choose:

- Send money instantly to cards 1

- Send money next-day to bank accounts via ACH

One seamless API integration, powerful custom dashboards, embedded compliance, and more equip you with the tools you need to start sending money quickly and efficiently manage your payouts. Easily toggle between your Payments and Payouts in your dashboard with an all-in-one provider that helps you power both.

To learn more, visit Payouts.

1Actual fund availability depends on receiving financial institution and region

December 2023

Power checkouts across channels with Payment Links

Our new Payment Links enable you to easily create shareable links you can use to accept payments from buyers online–with no code required. You can share these links across a variety of channels, like sms, email, and social, or embed them into QR codes, content, buttons, and more— anywhere a link can go!

You can create these links in the new Payment Links section of your dashboard–note, this requires admin-level permissions. In this new section of the dashboard, you can track and analyze all the links you’ve created and payments you’ve received for a specific link. You can also integrate with our Payment Links via API if you’re looking to create custom payment workflows with your own internal tools.

To learn more, please see Payment Links.

Accept payments quickly on your website with pre-built Checkout Pages

Our new Checkout Pages equip you with a pre-built payments page you can easily embed into your website’s checkout flow. Instead of building a secure, friction-free checkout page from scratch, you can easily redirect buyers to our hosted page when they’re ready to make a payment—saving your developers time by taking care of aspects like compliance, security, and the user experience for you. Our checkout pages are built for both mobile and desktop, providing buyers with an optimized experience no matter what device they’re using.

Checkout Pages are available via API and can be customized to match the look of your brand and unique checkout requirements.

To learn more, please see Checkout Pages.

Take payments from your browser with the new Virtual Terminal

With our new Virtual Terminal, you can manually take payments right from your Finix dashboard. This allows members of your team with admin-level permissions to manually key in and process payments received over the phone, via mail, in-person or other channels without a physical point of sale or online checkout form required. This enables you to accept payments in a more convenient way for certain customers and power sales you’d otherwise miss.

To learn more, please see Virtual Terminal.

November 2023

New Tokenization Forms: Securely accept payment details with less code

We’ve released a new suite of embeddable payment forms that make it easier to securely accept payment information in your app or website. These low-code tools seamlessly integrate into your checkout flow to help you accept and tokenize card and bank account details buyers enter for a payment–reducing your compliance burden with data securely handled by Finix.

Compared to our existing Hosted Fields, these pre-built forms require minimal code–developers can get started with less than 10 lines of code. They also give you more control over customization to match the look of your brand and unique checkout requirements. Plus, better error handling and validation and a more intuitive design to help drive conversions.

To learn more, see Tokenization Forms.

October 2023

Split transactions in your Finix sandbox dashboard

You can now view and manage test split transactions in your Finix sandbox dashboard. Split transactions enable you to split the funds from a singular transaction across several different sellers.

Please note, Split Transactions is currently in early access and subject to further changes. For more information, reach out to the Finix Support Team.

To learn more about Split Transactions, see Split Transactions.

September 2023

New insights for customers who manage sellers

If you’re a Finix customer who manages sellers, you can now access a brand new Insights page that helps you get a holistic look at your merchant management activity. Get an at-a-glance view of key metrics, see trends around onboarding statuses and active merchants, analyze transaction data by each of your merchants and other variables, and more, right in your Finix dashboard.

Just like other insights in our dashboard you can easily slice and dice these data points across specific time frames and variables to find the exact info you’re looking for.

Enhanced dispute search with 30+ new filters

We’ve added more than 30 new filters to help you easily search, sort and export your dispute data. These dispute filters are available via both dashboard and API and are especially helpful if you’re looking to pull on-demand CSV reports of your disputes customized around your desired parameters.

For more information, see List Disputes.

August 2023

New Exceptions Insights page

We’ve added a brand new Exceptions Insights page with two individual tabs for Disputes and ACH Returns data. Get a simpler view of your exception management with key dispute and ACH return metrics at-a-glance and track data across specific time periods and different filters.

Introducing 6 new in-person payment terminals

We’ve introduced six additional payment terminals to our diverse selection of supported in-person payments hardware. These newly added devices feature a wide array of form factors and functionalities to help support all your in-person payment needs.

For more information on the terminals Finix supports, see Managing Payment Terminals.

Enable surcharging for in-person payments via API

You can now enable buyer surcharge fees for your merchants on in-person payments via API.

Please consult your legal counsel if you have questions about a seller's eligibility to assess surcharges or surcharging requirements. Eligibility and requirements are governed by applicable state laws and card brand rules.

For more information, see Buyer Charges.

Tokenize international cards on iOS and Android devices

You can now tokenize international cards on both iOS and Android devices using our mobile tokenization tools. Previously, mobile tokenization was limited to only cards issued within the U.S.

Please note, this only applies to international card transactions with U.S. merchants, in which the international currency is converted into USD.

For more information, see Mobile Tokenization.

Easier bulk exports on dashboard pages

Exporting payments data in the dashboard is now a whole lot easier! We added the ability to seamlessly perform bulk exports on the Authorizations, Merchant Accounts, Settlements, Disputes and Settlement Entries pages of the dashboard. Instead of needing to scroll through all the data listed on these specific pages first, you can now generate a bulk export for all the available data with a single click of a button.

Test Split Transactions via API in your Finix sandbox

You can now test split transactions in the sandbox via API. Split transactions enable you to split the settlements from a singular transaction across several different test sellers.

Please note, Split Transactions is currently in early access and subject to further changes. For more information, reach out to the Finix Support team.

To learn more about this feature, see Split a Transaction.

July 2023

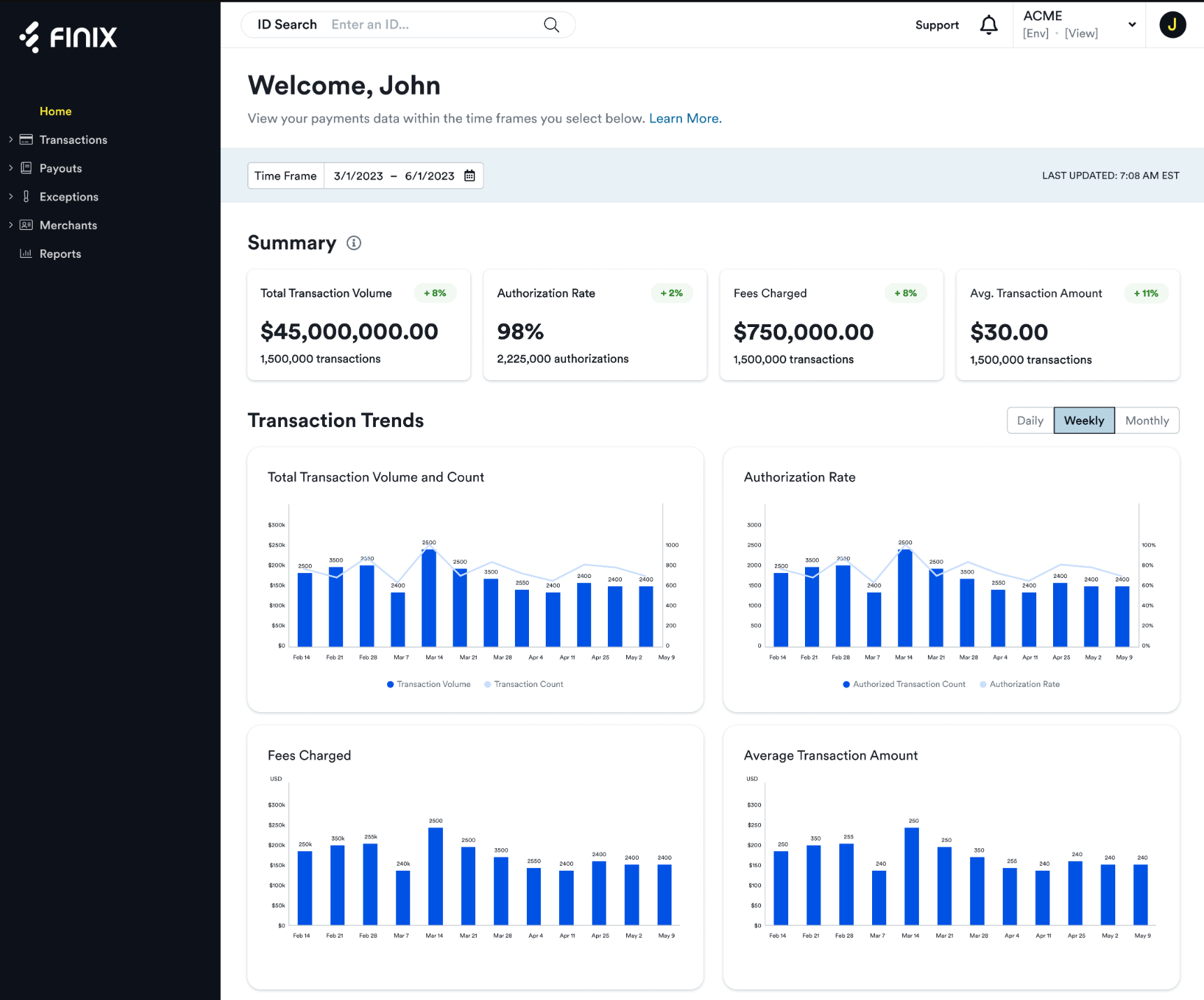

40+ New Insights & Analytics in the Finix Dashboard

We’ve upgraded the Finix dashboard with dozens of new metrics, charts and visuals to help you see your payments data in powerful new ways.

Redesigned Homepage

Get a comprehensive look at your payments activity with the sleeker, smarter and more data-rich Home page. Use the new and improved Home page to get an at-a-glance view of your most important metrics with interactive visualizations and other key insights that can be sliced and diced across specific time periods and a variety of data points with enhanced filtering.

New Transaction Insights page

We’ve added a brand new Transaction Insights page with three individual tabs to visualize your Payments, Authorizations, and Refunds data. View and filter across different card brands, payment methods, issuer countries, merchants, date ranges, and more to get a deeper look at your transaction data.

Stay tuned for even more data and analytics tools coming to your dashboard soon!

June 2023

Seamlessly upload dispute evidence files via dashboard

We’ve made the experience of responding to disputes in the Finix dashboard a lot more seamless. You can now upload and submit dispute evidence files (receipts, shipping information, customer communications, etc.) directly in the Finix dashboard. Once submitted, we’ll then forward the uploaded evidence to support your defense against the dispute.

For a single dispute, you can upload up to 8 files (total size of all files must be less than 10 mb) in JPG, PNG, or PDF formats. We also recommend using the “Summary of Evidence” field to include information that describes or supports the evidence you’ve uploaded for the issuer to review. After we forward your evidence to the appropriate parties, we’ll update the status of your evidence files to confirm they were submitted successfully.

For more information, please see Uploading Evidence on the Dashboard.

This functionality is also available via API.

Easily accept and close disputes in the dashboard

If a dispute gets filed that you don’t want to challenge, you can now easily accept and close that dispute directly in the dashboard.

Reasons you might want to accept liability for a dispute could include:

- The buyer’s dispute is valid .

- There isn’t sufficient evidence to counter the claim.

- Low transaction amount that doesn’t justify the time/resources needed to respond to the dispute.

- You suspect there is fraud or it was caused by an internal issue.

On Pending disputes, you’ll now see a button to “Accept Liability”. You can also include a note to communicate to the issuer why it was accepted and provide any other relevant information.

We’ll then forward this information to the appropriate parties to finalize acceptance of the dispute. For more information, please see Accepting a Dispute.

This functionality is also available via API.

Please note, this action is final and accepted disputes count toward your maximum permitted quantity. Once accepted, the dispute will move to a closed state.

Auto-complete for merchant addresses on Hosted Onboarding Forms

We’ve added Google address autocomplete to Finix hosted merchant onboarding forms to provide a more convenient experience for your merchants and better ensure the accuracy of the address information they provide.

Now when a user is filling out an onboarding form and begins to enter their address, the field will expand into a list of predicted matches they can select from to autocomplete the field based on the info they’ve already typed.

Developers can now see raw API response on failed Transfers

If a transfer fails, the raw API response is now available for review in the Finix Dashboard. This is especially helpful for developers who can quickly access the response to see why the payment failed and troubleshoot.

Upgraded disputes dashboard UI

We’ve added and improved elements of the Disputes section of the dashboard to better deliver the critical information you need to manage disputes.

This includes:

- New Respond Within column on the Disputes page that shows how many days you have left to respond to a dispute

- New Card Last 4 column on the Disputes page that shows the last 4 digits and card brand associated with a dispute

- Improvements to the layout of individual Dispute pages

Updated look & feel for payout settings

We’ve refreshed the look and feel of payout settings in the dashboard to make them more intuitive.

Changes include various copy, layout, and visual updates that make it easier to see all payout settings you have configured and when settlements and fees get delivered.

Added id fields for dispute and dispute evidence files APIs

We added new fields to the Dispute and Dispute Evidence APIs that makes it easier to manage these resources; especially if you have multiple applications or merchants with Finix.

-

Added

applicationto the Dispute Evidence File resource. -

Added

identityandmerchantto Dispute and Dispute Evidence File resources.

User permissions list on team member view page

Administrators managing your company’s team members and roles, can now see all the permissions enabled for a given user when looking at a specific team member’s user page in the dashboard.

This permission list helps provide at-a-glance information on what level of access to sensitive payments data and available actions a specific user of yours has.

Surcharge enabled is now on merchant resource

We added a field to the Merchant API resource that details if a seller has surcharges enabled to make it easier for you to identify if processing surcharges is active for the seller.

May 2023

Easily Link Disputes and Dispute Evidence with Tags

You can now add and edit tags for Disputes and Dispute Evidence Files via API, just like you would for the other Finix API resources you use (Transfers, Payment Instruments, etc.)

Assigning tags to Disputes and Dispute Evidence files allows you to seamlessly link Finix dispute resources to your own system and include additional data about disputes, such as a custom unique id.

For more details on using tags, see Tags.

Upgraded Dashboard Date Selection Button

We’ve upgraded the look and feel of the date selection button that appears throughout the Finix dashboard, to make filtering your dashboard payments data by specific dates or periods more seamless and dynamic.

Prevent Duplicate Refunds

You can now include an idempotency_id when creating a Refund or Reversal. Including this unique identifier with your refund API requests helps ensure that even if duplicate API requests for the same refund are sent, the refund is only initiated once. This is key, because sometimes an issue like an interruption with your network connection or problem with your server can cause an API request for the same refund to get submitted multiple times.

For more details on the idempotency_id, see Idempotency Requests.

Validate and Tokenize Bank Accounts at the Same Time

You can now validate new bank accounts when they’re tokenized and used to create payment instruments. This helps you know for certain whether a new bank account is valid before using it in a transaction.

To verify that a bank account actually exists when creating a token, you can include the attempt_bank_account_validation_check field. If a bank account doesn’t exist, the token will create a payment_instrument with an error in the address_verification field.

- For details on how to tokenize the details of a bank account, see Tokenization Forms .

- For details on how to create a Payment Instrument using a token, see Create a Payment Instrument .

Edit Buyer Names for Payment Instruments via API

The name of a buyer linked to a payment instrument (card, bank account, token, etc.) can now be edited via API. This is helpful in situations where you need to change a name to correct an error or reflect an update to the name of the payment instrument’s owner.

To update the name associated with a Payment Instrument, see Update a Payment Instrument.

April 2023

Apply for Live Payment Processing via the Finix Sandbox

You can now apply for a live payment processing account in the Finix Sandbox!

The Finix Sandbox allows you to easily sign up for an account via our website to explore the Finix dashboard and simulate what your live production experience would be - including accepting test payment transactions, simulating merchant payouts, and building test integrations with Finix.

If you’re ready to start processing payments with Finix, you can easily apply for a live account via your sandbox dashboard, by submitting all the needed application info and selecting what pricing schema and business configuration works best for you. If approved, you can begin accepting payments with Finix in live production.

More Failure Codes for Processing In-Person Payments

Below, we’ve added two additional in-person payment failure codes to help you better understand why a certain transaction failed and trigger your own workflows in response to the issue. You can see the full list of failure codes and associated failure messages here.

- DEVICE_IN_USE: The device is currently processing a request. Attempt a request again once the request is complete, or within 6 minutes.

- DEVICE_NOT_ENABLED: The device is not activated. Please activate the device and try again.

We also updated the failure messages for the following existing in-person payment failure codes:

- GENERIC_DECLINE: The transaction was declined for an unknown reason. The account owner needs to contact their issuer for more information.

- TRANSACTION_NOT_PERMITTED: The transaction was declined because the card or transaction type is not permitted. The cardholder needs to use a different type of card or attempt a different transaction method.

Faster in-person payments

In-person payments are now faster than ever! We’ve improved the time it takes our in-person payments API to share the result of a transaction with your system to an average speed of 0.5 seconds. This helps speed up the overall transaction flow and deliver more seamless checkout experiences for your buyers.

Webhook enhancements

To make your dashboard experience more intuitive and powerful, we’ve added the Onboarding Form webhook event to dashboard and Updated API + Webhook logs.

March 2023

Payment Solutions for Individual Businesses and Online Marketplaces

Finix’s payment platform can now support Individual Businesses and Online Marketplaces, in addition to our existing customer segments.

This release delivers more configurations of our platform and different bundles of features for payments solutions tailored to the unique needs of different supported business models and their specific payments use cases.

We support:

- Individual Businesses: eCommerce and other individual businesses who sell goods and services directly to buyers online, in-person, or both.

- Software Platforms: SaaS companies offering embedded payments to their customers online, in-person, or both.

- Online Marketplaces: Digital marketplaces that connect buyers and sellers online.

- Payfacs: Large enterprise organizations registered as payment facilitators.

For more info, see Who We Serve.

Customized Developer Sandboxes for Different Business Types

We’ve enhanced the Finix Sandbox to provide tailored testing experiences for different types of businesses. This latest release adds specialized sandbox environments for different business types, including Software Platforms, Online Marketplaces and Individual Businesses. Now, when a user signs up for a Sandbox account, they will select their business type and be taken to a Finix Sandbox dashboard designed specifically for the business type they selected.

The Finix Sandbox allows users to easily sign up for an account via our website and explore the Finix dashboard and simulate what their live production experience would be - including accepting test payment transactions, simulating merchant payouts, and building test integrations with Finix, all before applying for a live production account.

For more info, see Signing up for a Finix Account.

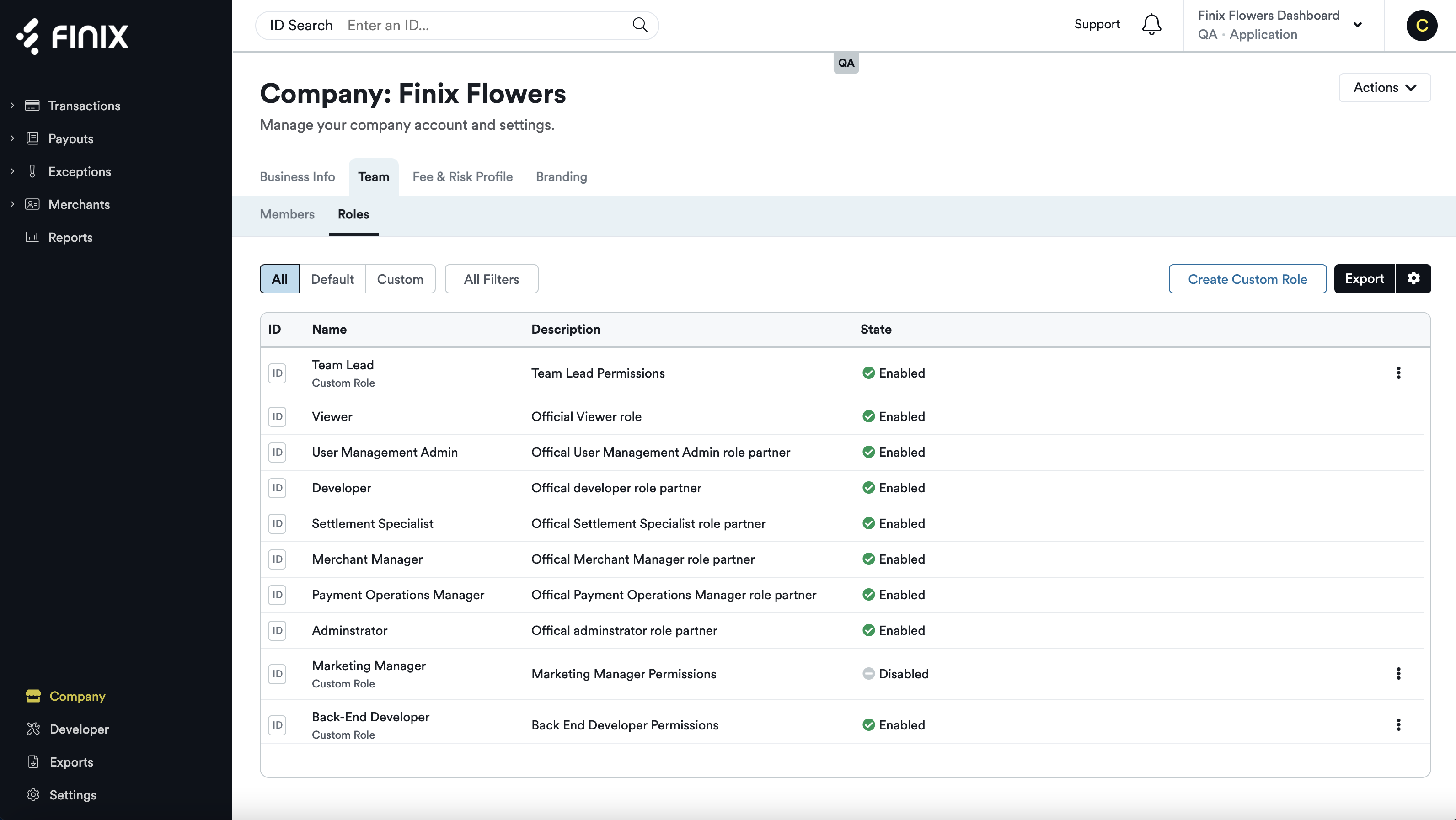

Updated Finix Team Members & Roles in the Finix Dashboard

This feature enables customers to manage their Team Members, Roles, and access levels in the Finix dashboard. These enhancements make it possible for administrators (those with the highest level of access) to add, customize, and manage the users from their company, directly in the Finix dashboard. Managed permissions provide enhanced security and limit who can see sensitive payments data.

In the Finix dashboard you can now easily:

- Add and deactivate team members

- Assign different permission-based roles

- Create custom roles to address unique business needs

The variety of configurable profiles to choose from include:

- Administrator

- Payment Operations Manager

- Merchant Manager

- Settlement Specialist

- Developer

- Viewer

- User Management Admin

- Custom Roles

Customers can seamlessly manage which team members have access to their company’s dashboard and their specific permissions, deactivate users who no longer need access, as well as create new custom roles tailored to their unique user requirements.

A common example of a custom role you might create is for an outside accountant, who may need access to specific data for a set amount of time during the year. Start managing your team’s roles and permissions here.

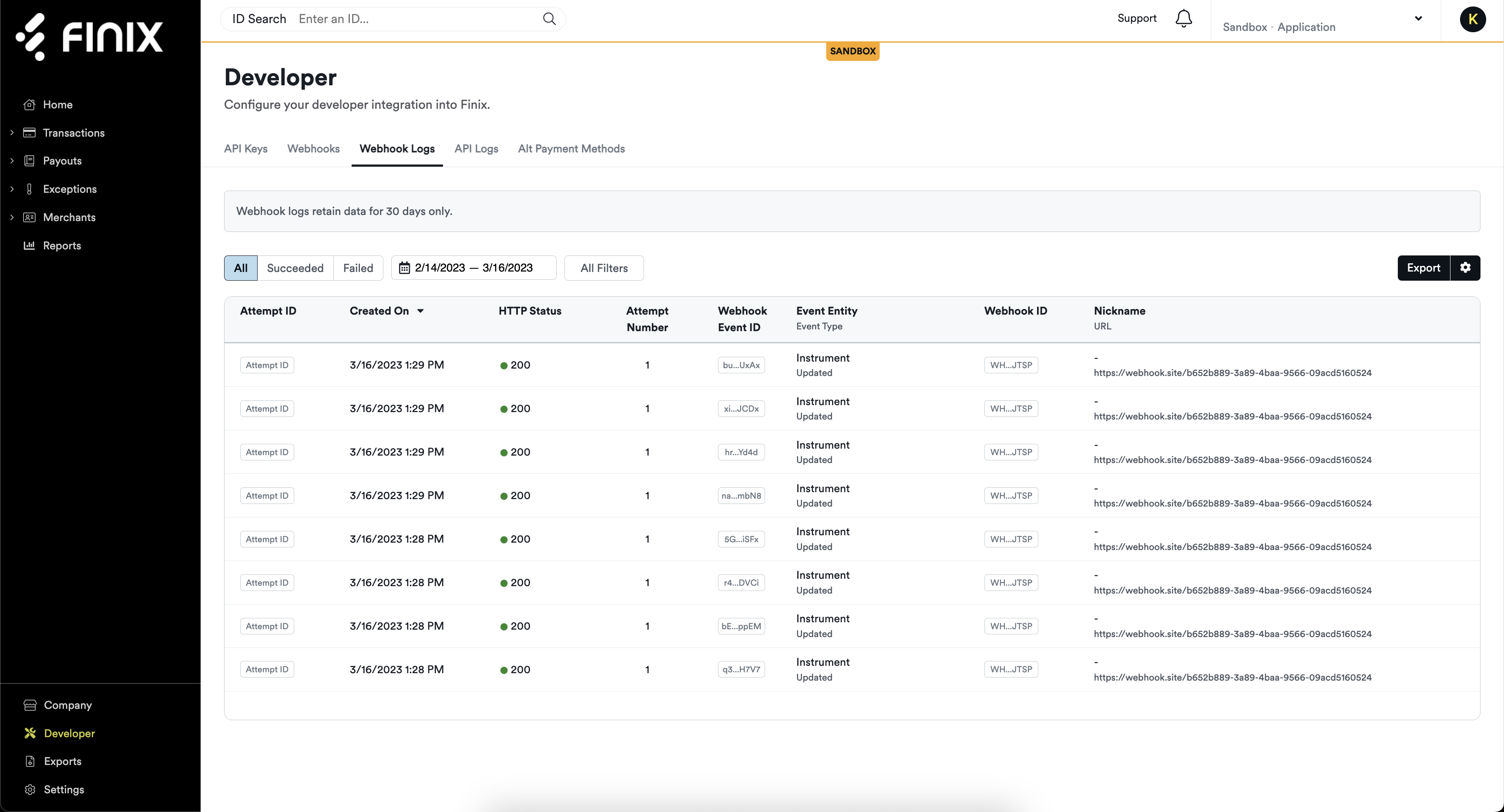

Webhook Event Logs

..

..

From the developer section of the dashboard, users can now review logs that detail all the webhook events they’ve received. Developers are also able to receive dashboard and email notifications about webhook events they’ve received.

With an easily accessible log you can check at any time, it’s an easier path to debug, troubleshoot, and audit the activity you process.

The webhook events log allows you to:

- Review how webhooks are configured

- Review a history of all webhook event attempts

- Filter webhooks by attempts and troubleshoot any failed events

- Reattempt events that have failed

- Enable email and in-dashboard notifications for failing webhooks

Save Time & API Calls with the New Merchant Field on Transfers and Authorizations

Now that we’ve added the merchant field to Transfers and Authorizations, you can save multiple API calls by directly referencing a Merchant resource instead of using the Seller’s Identity to reach it. This is especially helpful when you’re looking to understand the origin of a transaction.

More Dispute Functionality Available in the Finix Sandbox

In the Finix Sandbox, users submitting and accepting disputes will now receive an API response that echoes the Dispute resource. Previously, they’d only receive a return indicating that their API call was accepted and that the dispute exists. This update allows Sandbox users to better simulate disputes with more of the same functionalities they’d experience with a live payment processing account, like seeing the status of a dispute (“Won", “Closed” and “In Progress”), as well as other information.

For more details, see Responding to Disputes.

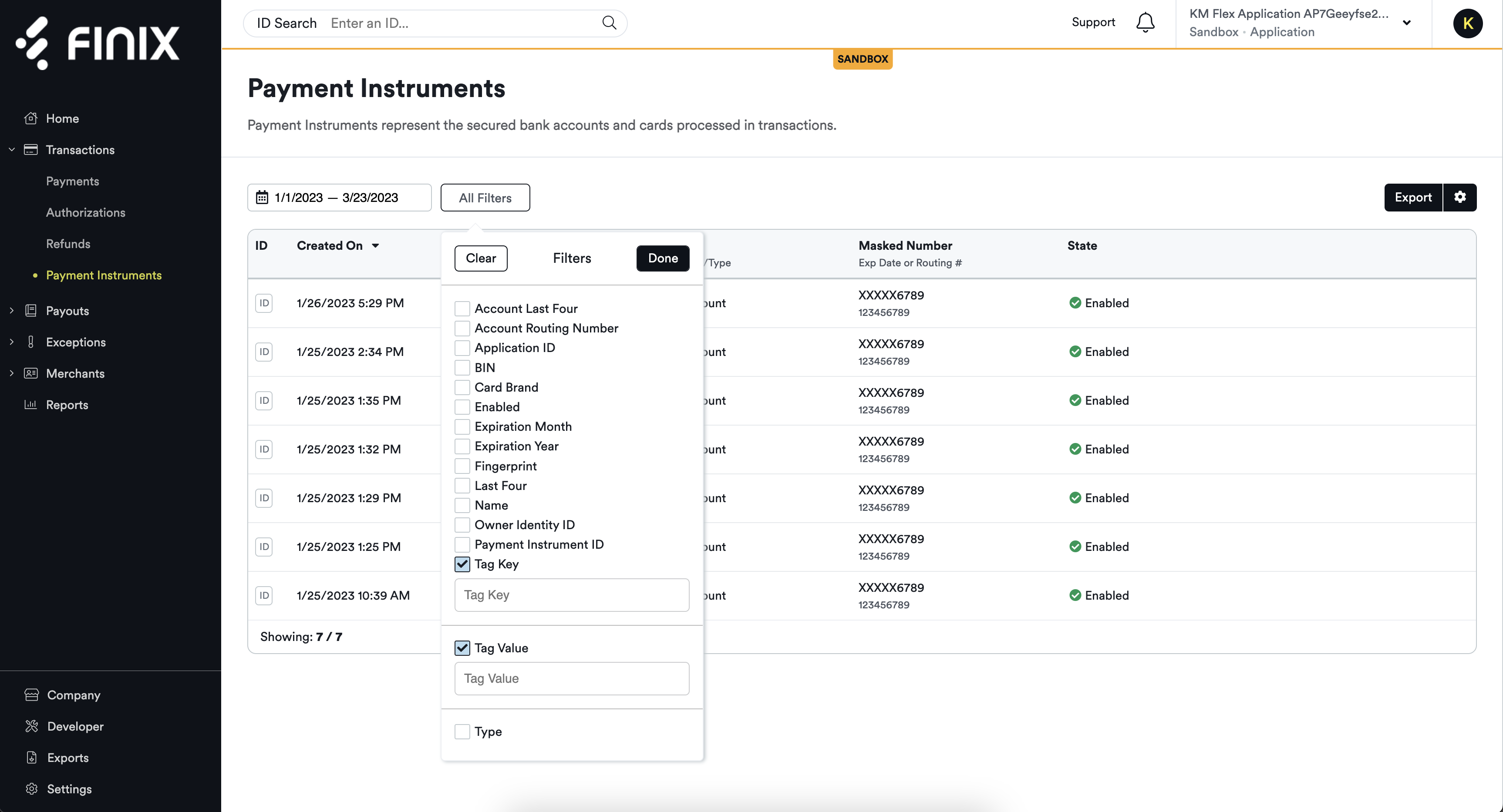

Improved Search Functionalities - Find the info you need more easily

Customers now have the ability to search for tags in the dashboard.

You can now search the following resources by the keys and values of any tags that have been applied:

-

Authorizations -

Transfers -

Payment Instruments -

Identities

Customers can also search for tags in the Finix API using our new tag filters, allowing you to enable more functionality with our system and the ability to link your own system’s IDs with Finix.

We've also made general improvements to the logic around our search! You can type partial words or terms and we’ll return all results that include that partial search term.

Max Transaction Limit on ACH

Using our API, customers can set a different maximum transaction limit for ACH Direct Debits than the maximum set for Credit Card transactions. This gives you flexibility with ACH Direct Debits and allows you to create a maximum transaction limit specifically for ACH transactions.

For more details see the ach_max_transaction_amount field.

February 2023

Android Mobile Tokenization

Android Tokenization enables you to accept and tokenize payment details in your Android app without exposing yourselves to PCI risk.

This completes the rollout of our tokenization offerings, which now includes: web, iOS, and Android.

Test ACH Returns in Sandbox

You can now test ACH Returns in your sandbox! This enables you to test scenarios, process failure reasons, and help your sellers understand how to handle failed ACH payments–all in a test environment. Tests include:

- Insufficient Funds

- Account is Closed

- No account on file

- Invalid Account Number

For more details, see Testing ACH Returns.

December 2022

Dashboard Updates

This is the last of a three-part release to refresh the user experience of our entire dashboard. The additional user experience improvements include reorganizing the Application, Merchant, and Push-to-Card pages to simplify where to find the most helpful information and make finding that information more intuitive. The changes made to the dashboard the past three weeks should help you complete tasks more quickly and efficiently–for example, by using new filters to easily create on-demand reports for information you’re seeking, or using the click-to-copy function to accurately and efficiently transfer data to external databases.

For more information about what's available in the Finix Dashboard, see Finix Dashboard.

November 2022

New Dashboard Designs, Embedded Onboarding Forms, & Payout Settings

-

Thanks to the collective feedback from our customers about the Finix Dashboard, every page of the Finix Dashboard has been redesigned, focusing specifically on how content is organized, utilized by different teams (such as features catered to developers and to payment operations), and laid out for greater clarity, discoverability, and ease of use. This release kicked off the implementation of those designs.

-

We’ve updated naming conventions to be more intuitive, for instance: “Transfers” that are buyer purchases are now called “Payments” in the dashboard. Payments now appear along with “Authorizations” and “Refunds” in the “Transactions” list in the left navigation bar of your dashboard.

-

We’ve better organized pages within each section of the dashboard, and added more filters so you can easily sort and report on information you want to see at any given time. These filters are also helpful to pull on-demand reports from the dashboard so that you don’t need to wait for settlement reports, which come at the end of the day and include comprehensive information, which may not be needed if your goal is to extract a finite set of information from a given time period. These reports can be found in your exports section of the dashboard–at the bottom left–so you can go back and reference them at any time. You can also download them as a CSV file.

-

Lastly, we improved the settlements experience with detailed page headers that showcase the payout type of a given transaction (such as net versus gross payout type).

-

We released an entirely new suite of payment terminals for

In-Person Payments

including the addition of new Finix Mobile SDKs and new Finix APIs so that you can choose the software and hardware pairing that works best for your business.

-

You can now white label using your own branding with Finix!

- You can now white-label, or customize your dashboard, your merchants’ dashboards, and embedded merchant onboarding forms using your own company branding - including your company logo and colors.

- White labeling creates a consistent user experience for your merchants which can lead to increased trust and translate to a higher willingness to complete onboarding more quickly.