Sellers can accept payments from buyers using a US-based bank account. These payments are referred to as ACH Direct Debits.

ACH Direct Debits as an alternative to credit and debit cards. ACH Direct Debits are processed using the Automated Clearing House (ACH) payments system operated by Nacha.

ACH Direct Debit Payments

Unlike credit card payments, ACH Direct Debit payments are not a real-time payment method. It can take 4-10 business days to fully authorize the transaction with the buyer's bank and confirm if it failed or succeeded. Buyers can dispute the transaction up to 60 days from the initial payment date.

To process a payment using ACH Direct Debit, collect the following from the buyer and create a Payment Instrument:

| Detail | Description |

|---|---|

| Bank Code | The routing number of the buyer's bank account. |

| Account Number | The account number of the buyer's bank account. |

| Buyer Name | The buyer's name. |

You can collect this information using our API or our Tokenization Forms.

ACH Direct Debit States

You can review the three states for ACH Direct Debit payments below. ACH Direct Debit payment gets created with Transfer#state PENDING:

Transfer#state |

Description |

|---|---|

| PENDING | The ACH Direct Debit is being processed by Finix. |

| SUCCEEDED | The ACH Direct Debit was accepted by Finix. The payment may or may not have been accepted by the buyer's bank at this time. |

| FAILED | The ACH Direct Debit was not accepted by Finix. |

attention

Transfer#state SUCCEEDED only means Finix submitted details to the ACH networks. It can take 4-10 business days for the buyer's bank to process and confirm the debit was successful.

ACH Timing

ACH Direct Debits take longer than credit card payments to move and settle funds. To account for this, Finix creates a delay to accommodate any ACH Returns that could occur. This delay is called an ACH Settlement Delay.

By default, Finix puts in a 5-day delay before ACH Direct Debits can settle and become available for approval in a Settlement.

Sellers may want ACH Debits to appear in settlements faster or slower based on their business. For example, the ACH Settlement Delay can be:

-

Decreased, so ACH Direct Debits appear in

Settlementsfaster. This can result in ACH Returns appearing after paying out an ACH Direct Debit. - Increased, so sellers have more certainty before paying out ACH Direct Debits. This helps make sure payouts to sellers always include ACH Returns.

To configure or change this delay, reach out to your Finix point of contact or email the Finix Support team.

Validating Bank Accounts

In compliance with Nacha's bank account validation rule, Finix validates every bank account before proceeding with any ACH transactions. Finix validates the bank account the first time it's used, or after any change gets made.

The Transfer#bank_account_validation_check field details the results of this validation check. The following values get returned for Transfer#bank_account_validation_check when creating an ACH Direct Debit:

| Value | Description |

|---|---|

| NOT_ATTEMPTED | Default value for new bank accounts that haven't been validated yet. |

| VALID | Bank account was found and confirmed to accept ACH Direct Debits. |

| INVALID | Bank account couldn't be found or validated. A Transfer created with a bank account marked INVALID will fail. Please contact the account holder to confirm details or request a different payment method. |

| INCONCLUSIVE | Bank account couldn't be found and validation was INCONCLUSIVE. Bank accounts marked as inconclusive can still be used to create an ACH Transfer. |

ACH Direct Debit Authorization Language

Before processing any ACH Direct Debit payments, the buyer must agree to the following statement:

By clicking submit, you authorize us to initiate an automated clearing house (ACH) one-time debit in your name to your bank account indicated above. The amount of this transaction as noted above will be presented to your financial institution by the next business day. You further agree that once you click submit you may not revoke this authorization or cancel this payment.

We recommend presenting this language in your checkout flow right before the buyer clicks the Submit button and triggers the creation of the payment.

ACH Direct Debit Confirmation Language

After the payment is submitted, present a confirmation screen and/or email a confirmation to the buyer with the following language:

Thank you for your payment in the amount of $xx.xx. Please print this authorization for your records.

You have authorized us to initiate an automated clearing house (ACH) one-time debit in your name to your bank account. This transaction will be presented to your financial institution by the next business day. You further agree that you may not revoke this authorization or cancel this payment.

Failed ACH Direct Debits

An ACH Direct Debit can fail for a variety of reasons, including:

- Incorrect or Invalid Account Number.

- Buyer's bank account blocks ACH Direct Debits.

- Insufficient funds from a buyer's bank account.

- Buyer files a dispute on a payment they didn't agree to.

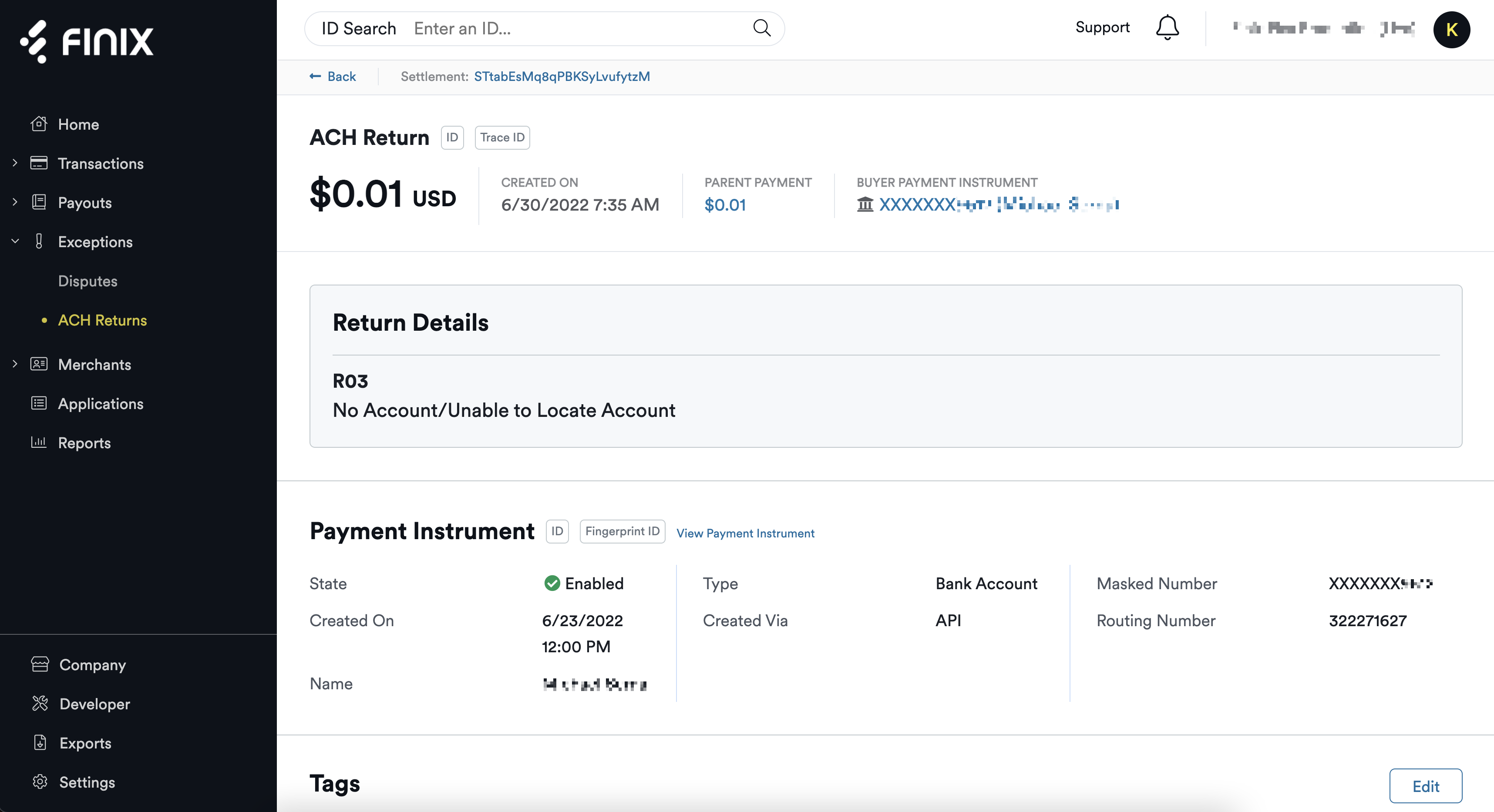

When a ACH Direct Debit fails, Finix creates an ACH Return to recover the original payment amount.

ACH Returns are represented by a Transfer with:

-

Transfer#type: REVERSAL -

Transfer#subtype: SYSTEM

attention

Most disputes arise within 3-5 business days of the transaction. However, buyers can dispute ACH Direct Debits for any reason up to 60 days after the payment got processed. ACH Direct Debits older than 60 days are guaranteed not to be disputed or get returned.

A full list of reasons why an ACH Direct Debit can result in an ACH Return is available below.

ACH Return Codes Table

| Code | Description |

|---|---|

| R01 | Insufficient funds in account |

| R02 | Account is closed |

| R03 | No account on file |

| R04 | Invalid account number |

| R05 | Unauthorized debit to consumer account |

| R06 | Returned at request of ODFI |

| R07 | Authorization revoked by customer |

| R08 | Payment stopped |

| R09 | Insufficient collected funds in account being charged |

| R10 | Customer advises not Authorized, notice not provided, improper source document, or amount of entry not accurately obtained from source document |

| R11 | Check truncation return |

| R12 | Account sold to another financial institution |

| R13 | Invalid ACH routing number |

| R14 | Representative payee is deceased or cannot continue in that capacity |

| R15 | Beneficiary or account holder other than representative payee deceased |

| R16 | Account funds have been frozen |

| R17 | Item returned because of invalid data; refer to addenda fro information |

| R18 | Improper effective date |

| R19 | Amount error |

| R20 | Account does not allow ACH transactions or limit for transactions has been exceeded |

| R21 | Invalid company identification |

| R22 | Invalid individual ID |

| R23 | Credit entry refused by receiver |

| R24 | Duplicate entry |

| R25 | Addenda record error |

| R26 | Mandatory field error |

| R27 | Trace number error |

| R28 | Routing/transit number check digit error |

| R29 | Corporate customer advised not authorized |

| R30 | RDFI not participant in check truncation program |

| R31 | Permissible return entry |

| R32 | RDFI non-settlement |

| R33 | Return of item |

| R34 | Limited participation ODFI |

| R35 | Return of improper debit entry |

| R36 | Return of improper credit entry |

| R37 | Source document presented for payment |

| R38 | Stop payment on source document |

| R39 | Improper source document |

| R40 | Return of item by government agency |

| R41 | Invalid Transaction Code |

| R42 | Routing/transit number check digit error |

| R43 | Invalid account number |

| R44 | Invalid individual ID |

| R45 | Invalid individual name or company name |

| R46 | Invalid representative payee indicator |

| R47 | Duplicate enrollment |

| R50 | State law affecting RCK acceptance |

| R51 | Item is ineligible, notice not provided, signature not genuine, or original item altered for adjustment entry |

| R52 | Stop payment on item |

| R53 | Item and ACH entry presented for payment |

| R61 | Misrouted return - RDFI for original entry has placed incorrect routing/transit number in RDFI identification field |

| R67 | Duplicate return |

| R68 | Untimely return - return was not sent within the established time frame |

| R69 | Field errors |

| R70 | Permissible return entry not accepted |

| R71 | Misrouted dishonored return -incorrect routing/transit number in RDFI identification field |

| R72 | Untimely return - dishonored return was not sent within the established time frame |

| R73 | Timely original return - RDFI certifies the original return entry was sent within established time frame for original returns |

| R74 | Corrected return - RDFI is correcting a previous return entry that was dishonored because it contained incomplete or incorrect information |

| R75 | Original return not a duplicate |

| R76 | No errors found |

| R80 | Cross-border payment coding error |

| R81 | Non-participant in cross-border program |

| R82 | Invalid foreign RDFI identification |

| R83 | Foreign RDFI unable to settle |

| R84 | Cross-border entry not processed by originating gateway operator |

The details of ACH Returns are available to review in the Dashboard.

Creating an ACH Direct Debit

First, create a Payment Instrument to represent your buyer's bank account. Use our Tokenization Forms to collect the buyer's bank account and payment details.

info

You must create another Identity for your buyer. Create a Payment Instrument using this new Identity and the buyer's tokenized bank details.

Create a Transfer with the Payment Instrument you created to debit funds directly from the buyer's bank account.

curl https://finix.sandbox-payments-api.com/transfers \

-H "Content-Type: application/json" \

-H 'Finix-Version: 2022-02-01' \

-uUSsRhsHYZGBPnQw8CByJyEQW:8a14c2f9-d94b-4c72-8f5c-a62908e5b30e \

-d '{

"amount": 6031,

"currency": "USD",

"fee": 603,

"merchant": "MUeDVrf2ahuKc9Eg5TeZugvs",

"source": "PIr1Ru7ewBkEYVVn7SP1u5FW",

"tags": {

"order_number": "21DFASJSAKAS"

}

}'A successful response returns 201:

-

ACH Direct Debits return

Transfers#typeDEBIT. -

ACH Returns create a

TransferwithTransfer#typeREVERSAL andTransfer#subtypeSYSTEM. ThisTransfersubtracts the amount from the actively accruingSettlement.

Example Response:

{

"id" : "TR6Gnj38UyPW3CoukdL9WaR1",

"created_at" : "2022-10-10T05:34:16.13Z",

"updated_at" : "2022-10-10T05:34:16.68Z",

"additional_buyer_charges" : null,

"additional_healthcare_data" : null,

"address_verification" : null,

"amount" : 662154,

"amount_requested" : 662154,

"application" : "APgPDQrLD52TYvqazjHJJchM",

"currency" : "USD",

"destination" : null,

"externally_funded" : "UNKNOWN",

"failure_code" : null,

"failure_message" : null,

"fee" : 0,

"idempotency_id" : null,

"merchant" : "MUeDVrf2ahuKc9Eg5TeZugvs",

"merchant_identity" : "IDuqZpDw28f2KK6YuDk4jNLg",

"messages" : [ ],

"raw" : null,

"ready_to_settle_at" : null,

"security_code_verification" : null,

"source" : "PImmCg3Po7oNi7jaZcXhfkEu",

"state" : "PENDING",

"statement_descriptor" : "FNX*FINIX FLOWERS",

"subtype" : "API",

"tags" : { },

"trace_id" : "236e1149-9b83-4b79-bfaf-7ff810dcf601",

"type" : "DEBIT",

"_links" : {

"application" : {

"href" : "https://finix.sandbox-payments-api.com/applications/APgPDQrLD52TYvqazjHJJchM"

},

"self" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1"

},

"merchant_identity" : {

"href" : "https://finix.sandbox-payments-api.com/identities/IDuqZpDw28f2KK6YuDk4jNLg"

},

"payment_instruments" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1/payment_instruments"

},

"reversals" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1/reversals"

},

"fees" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1/fees"

},

"disputes" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1/disputes"

},

"source" : {

"href" : "https://finix.sandbox-payments-api.com/payment_instruments/PImmCg3Po7oNi7jaZcXhfkEu"

},

"fee_profile" : {

"href" : "https://finix.sandbox-payments-api.com/fee_profiles/FPvCQUcnsueN3Bc3zR1qCBG8"

}

}

}Transfer#ready_to_settle_at details when the Transfer will get included in the next Settlement that closes for the Merchant. Like other Transfers, Transfer#ready_to_settle_at gets updated (within the hour) with a timestamp.

You'll also receive a webhook with Webhook#type created and Webhook#entity transfer.

Example ACH Direct Debit Transfer Created

{

"type": "created",

"entity": "transfer",

"occurred_at": "2022-09-01T20:36:20.588717",

"_embedded": {

"transfers": [

{

"idempotency_id": null,

"amount": 6031,

"trace_id": "0156ff8f-88c1-4090-8eb6-9f33218b0ec5",

"failure_code": null,

"fee": 603,

"destination": null,

"raw": null,

"created_at": "2022-09-01T20:36:08.13Z",

"source": "PIr1Ru7ewBkEYVVn7SP1u5FW",

"merchant" : "MUeDVrf2ahuKc9Eg5TeZugvs",

"merchant_identity": "IDuqZpDw28f2KK6YuDk4jNLg",

"failure_message": null,

"type": "DEBIT",

"tags": {

"order_number": "21DFASJSAKAS"

},

"statement_descriptor": "FNX*FINIX FLOWERS",

"additional_buyer_charges": null,

"ready_to_settle_at": null,

"application": "APgPDQrLD52TYvqazjHJJchM",

"updated_at": "2022-09-01T20:36:08.69Z",

"subtype": "API",

"externally_funded": "UNKNOWN",

"messages": [],

"currency": "USD",

"id": "TRoom5emPxiP1TRAmHcSjHgz",

"state": "SUCCEEDED"

}

]

}

}For more information, see Paying out Transfers.

Refunding an ACH Direct Debit

Refunding an ACH Direct Debit is similar to refunding a Transfer. Use the /reversals endpoint to create a Transfer that moves funds back.

Create a Transfer reversal using the Transfer#id of the original ACH Direct Debit that you want to reverse.

curl https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1/reversals \

-H "Content-Type: application/json" \

-u USsRhsHYZGBPnQw8CByJyEQW:8a14c2f9-d94b-4c72-8f5c-a62908e5b30e \

-d'

{

"refund_amount" : 6031,

"tags" : {

"test" : "refund"

}

}'A successful response returns 201 and a new Transfer with type REVERSAL. The original Transfer#id is listed under _links#parent at the end of the URL.

{

"id" : "TRnqh2Mt6pnnPumxvenDmVjX",

"created_at" : "2022-10-10T05:36:19.18Z",

"updated_at" : "2022-10-10T05:36:19.27Z",

"additional_buyer_charges" : null,

"additional_healthcare_data" : null,

"address_verification" : null,

"amount" : 6031,

"amount_requested" : 6031,

"application" : "APgPDQrLD52TYvqazjHJJchM",

"currency" : "USD",

"destination" : "PImmCg3Po7oNi7jaZcXhfkEu",

"externally_funded" : "UNKNOWN",

"failure_code" : null,

"failure_message" : null,

"fee" : 0,

"idempotency_id" : null,

"merchant" : "MUeDVrf2ahuKc9Eg5TeZugvs",

"merchant_identity" : "IDuqZpDw28f2KK6YuDk4jNLg",

"messages" : [ ],

"raw" : null,

"ready_to_settle_at" : null,

"security_code_verification" : null,

"source" : null,

"state" : "PENDING",

"statement_descriptor" : "FNX*FINIX FLOWERS",

"subtype" : "API",

"tags" : {

"test" : "refund"

},

"trace_id" : "5cc0ab4e-3609-4a13-a9c3-b435328360c1",

"type" : "REVERSAL",

"_links" : {

"application" : {

"href" : "https://finix.sandbox-payments-api.com/applications/APgPDQrLD52TYvqazjHJJchM"

},

"self" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TRnqh2Mt6pnnPumxvenDmVjX"

},

"parent" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TR6Gnj38UyPW3CoukdL9WaR1"

},

"destination" : {

"href" : "https://finix.sandbox-payments-api.com/payment_instruments/PImmCg3Po7oNi7jaZcXhfkEu"

},

"merchant_identity" : {

"href" : "https://finix.sandbox-payments-api.com/identities/IDuqZpDw28f2KK6YuDk4jNLg"

},

"payment_instruments" : {

"href" : "https://finix.sandbox-payments-api.com/transfers/TRnqh2Mt6pnnPumxvenDmVjX/payment_instruments"

},

"fee_profile" : {

"href" : "https://finix.sandbox-payments-api.com/fee_profiles/FPvCQUcnsueN3Bc3zR1qCBG8"

}

}

}The Transfer#state gets updated to SUCCEEDED when the refund gets processed. Buyers will see the refund returned as a credit within 5-10 business days, depending on their bank. ACH Direct Debit refunds can’t get canceled once processed.

ACH Refund Returns

Banks manage the ACH networks and often pre-fund transactions before debiting funds.

In some rare cases, an ACH Refund can get returned if the buyer:

- Account is closed or frozen.

- Makes a mistake while entering their bank information.

- Requests to reverse a pre-funded transaction.

When an ACH Refund gets returned, two Transfers get created to credit the funds back to the original bank account. The webhook events you receive, include the subtype:

-

MERCHANT_CREDIT:

one

Transferto return the funds back to the original bank account. -

PLATFORM_DEBIT:

one

Transferto debit funds that got credited proactively.

Example ACH Merchant Credit

{

"type": "created",

"entity": "transfer",

"occurred_at": "2022-09-01T20:49:23.437609",

"_embedded": {

"transfers": [{

"idempotency_id": null,

"amount": 6031,

"trace_id": "FNX3Rs9AKNwUVoVu112D40ec5",

"failure_code": null,

"fee": 603,

"destination": null,

"raw": null,

"created_at": "2022-09-01T20:36:08.13Z",

"source": "PIr1Ru7ewBkEYVVn7SP1u5FW",

"merchant" : "MUeDVrf2ahuKc9Eg5TeZugvs",

"merchant_identity": "IDuqZpDw28f2KK6YuDk4jNLg",

"failure_message": null,

"type": "REVERSAL",

"tags": {

"result_message_0": "ReasonCode: "

R03 ",

"result_message_1": "ReasonDescription: No Account Unable to Locate Account"

},

"statement_descriptor": "FNX*FINIX FLOWERS",

"additional_buyer_charges": null,

"ready_to_settle_at": null,

"application": "APgPDQrLD52TYvqazjHJJchM",

"updated_at": "2022-09-01T20:49:23.43",

"subtype": "MERCHANT_CREDIT_ADJUSTMENT",

"externally_funded": "UNKNOWN",

"messages": [],

"currency": "USD",

"id": "TRzoL5FmpxIP2TRAmHKSlHgz",

"state": "SUCCEEDED"

}

]

}

}Example ACH Platform Debit

{

"type": "created",

"entity": "transfer",

"occurred_at": "2022-09-01T20:49:23.437609",

"_embedded": {

"transfers": [{

"idempotency_id": null,

"amount": 6031,

"trace_id": "FNXff8f88c140908eb69f3321",

"failure_code": null,

"fee": 603,

"destination": null,

"raw": null,

"created_at": "2022-09-01T20:36:08.13Z",

"source": "PIr1Ru7ewBkEYVVn7SP1u5FW",

"merchant" : "MUeDVrf2ahuKc9Eg5TeZugvs",

"merchant_identity": "IDuqZpDw28f2KK6YuDk4jNLg",

"failure_message": null,

"type": "REVERSAL",

"statement_descriptor": "FNX*FINIX FLOWERS",

"additional_buyer_charges": null,

"ready_to_settle_at": null,

"application": "APgPDQrLD52TYvqazjHJJchM",

"updated_at": "2022-09-01T20:49:23.43",

"subtype": "PLATFORM_DEBIT_ADJUSTMENT",

"externally_funded": "UNKNOWN",

"messages": [],

"currency": "USD",

"id": "TRoom5emPxiP1TRAmHcSjHgz",

"state": "SUCCEEDED"

}

]

}

}