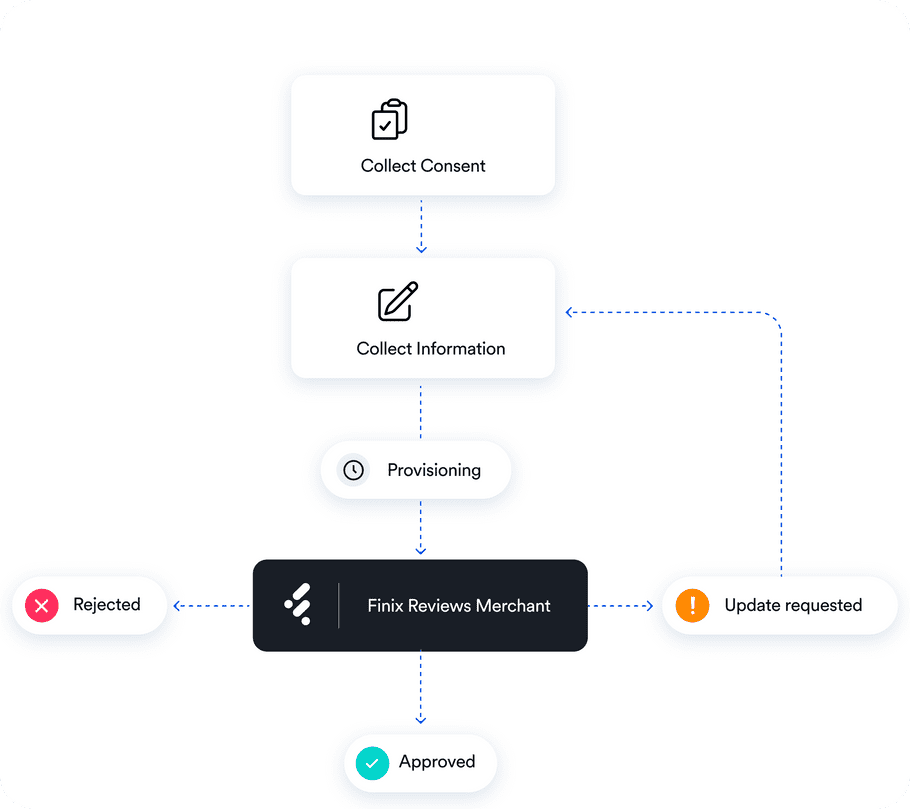

Whether you onboard your sellers with Finix's low-code / no-code Onboarding Forms, or use Finix's APIs directly, our onboarding process follows these four steps:

- Finix collects sellers' consent to the onboarding process

- Finix collects and reviews sellers' business, ownership, processing, and bank account information

- Finix requests additional information to help underwrite your sellers, on an as-needed basis

- Finix approves your sellers to start accepting payments with Finix

Seller Consent

Finix requires that sellers are presented with and agree to your Terms of Service and payment processing fees, as well as Finix's Terms of Service and Privacy Policy. Finix's Onboarding Forms present and collect consent to these materials seamlessly, making the process hands-off. If you onboard your sellers with Finix's APIs directly, you will need to build the process for presenting and collecting consent to these materials, as well as send the e-signature details to Finix.

Collected Information

Finix collects business, ownership, processing, and bank account information from your sellers. The exact required fields and data formats vary by sellers' business types and country. For more information, see Onboarding Data.

Business Information

Finix collects details about your sellers' business, and verifies these details as part of the customer identification process to help protect you and your sellers.

- Business address

- Business description

- Business incorporation date

- Business name

- Business phone number

- Business tax ID

- Business website

- Doing business as (DBA)

- Ownership type

Ownership Information

Finix collects details about your sellers' control owner, as well as any beneficial owners with at least 25% ownership of the business. Finix verifies these details as part of the customer identification process, helping protect both you and your sellers. Finix does not conduct hard credit checks on your sellers.

- Birthdate

- Business email

- Full legal name

- Home address

- Job title

- Ownership percentage

- Personal phone number

- Personal tax ID

Processing Information

Finix collects information about your sellers' processing activity to help configure their merchant account, including setting the maximum transaction amounts and Merchant Category Code (MCC) for processing payments.

- Card volume distribution

- Merchant Category Code (MCC)

- Processing volume

- Refund policy

- Statement descriptor

- Transaction sizes

Bank Account Information

Finix collects information about the bank account to send your seller's payouts. Finix verifies the bank account details and adds it to your seller's merchant account. Optionally, Finix supports providing these details through Plaid.

- Account name

- Account number

- Account type

- Routing number

Review Process

Finix reviews your sellers' information before approving them to process payments. This involves both automated and manual underwriting, and often takes just minutes. In some cases, Finix requests additional information from your sellers to complete the review process. This typically involves updating information or uploading documents. Finix's dashboard, Onboarding Forms, and APIs make the review process fast and easy, helping your sellers start processing payments in short order.

Merchant Account

Finix creates a Merchant account for your sellers during the onboarding process. The account transitions from PROVISIONING to APPROVED after the review process completes, at which point your seller is ready to accept payments. In the event Finix requests additional information from your seller, their account will move to an UPDATE_REQUESTED state that includes details about the information requested. Should Finix be unable to onboard your seller due to our risk decision, your seller's account will move to the REJECTED state.

What's next?

Continue reading to learn how to onboard your sellers with Finix's Onboarding Forms or APIs.